iowa capital gains tax real estate

Discover Iowa Capital Gains Deduction Land for getting more useful information about real estate apartment mortgages near you. This is your capital gain.

Long Term Capital Gains Tax Rates In 2020 The Motley Fool

The IRS typically allows you to exclude up to.

. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. Iowa has a unique state tax break for a limited set of capital gains. Take the purchase price of the home.

The sale price how much you sold. Includes short and long-term Federal and State Capital. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. It depends on your tax filing status and your home sale price but you may be eligible for an exclusion. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital.

Should the Department request it the information on the Capital Gain Deduction. Your tax rate is 0 on long-term capital gains if youre a single. At 22 your capital gains tax on this real estate sale would be 3300.

The long-term capital gains rate is 15 for single filers with taxable incomes between 40401 and 445850 and for couples filing jointly with incomes between 80801. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. Taxes capital gains as income and the rate reaches 853.

Iowa is a somewhat different story. The Combined Rate accounts for Federal State. When a landowner dies the basis is automatically reset to the current fair.

Individuals earning between 40001 to 441450 and married couples filing jointly making 80001 to 496600 face a 15 capital gains tax. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. This is the sale price not the.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. A Like-Kind Exchange with a conservation agency might help.

In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. Iowa allows taxpayers to deduct federal income taxes from their state taxable income. You will owe capital gains taxes on the 40 that you made from this transaction.

Hawaii taxes capital gains at a lower rate than ordinary income. Additional State Capital Gains Tax Information for Iowa. Two prices are involved in establishing a capital gain tax.

The highest rate reaches 11. Anyone earning beyond 441450. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate. A Special Real Estate Exemption for Capital Gains Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home is exempt from.

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Capital Gains Tax On Real Estate And How To Avoid It

Can You Avoid Capital Gains Taxes When Selling A Second Home Upnest

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

2021 Capital Gains Tax Rates By State Smartasset

What Is Capital Gains Tax And When Are You Exempt Thestreet

How High Are Capital Gains Taxes In Your State Tax Foundation

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Tax In Canada Explained

How Much Is Capital Gains Tax It Depends On Holding Period And Income

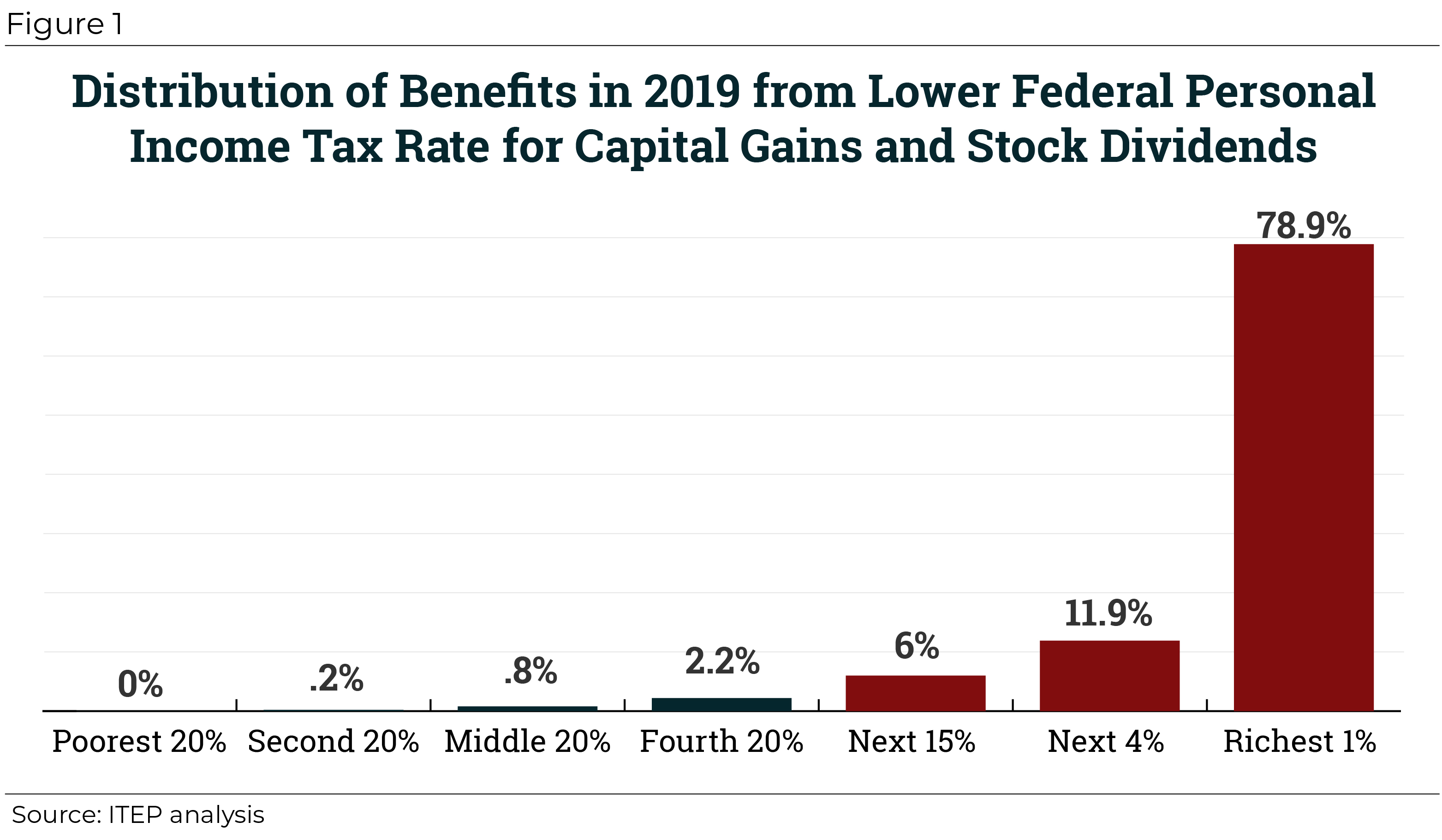

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

How Capital Gains Affect Your Taxes H R Block

Key Differences Between Canada And Us Tax Capital Gains Venture Cfo

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything